Which Two Categories Below Are Used for Business Costs

A Gross costs and net variable costs B Net variable costs and cost of goods sold C Cost of goods sold and other variable costs D Gross variable costs and net costs. Fixed asset cost which is used in production is measured in terms of depreciation and the cost.

Assets Vs Liabilities Top 6 Differences With Infographics Bookkeeping Business Financial Life Hacks Money Management Advice

There are several types of business costs.

. Which two categories below are used for business costs. The cost of labor for instance which is used to produce goods or render services is measured in terms of benefits or raises or even salaries. Cost of goods sold and administrative.

Direct expenses can be directly attributable to the sale of one unit. Gross and net b. Correct product costs for businesses that sell products of course are extremely important.

Fixed and variable d. There are two categories of variable costs. If you provide cell phones for field reps and outside sales people make sure that you include a separate expense for telephones.

The categories involved or used in business cost are. Materials and labor b. Fixed expenses are expenses that dont change for long periods of time like office rent or vehicle lease payments for you or your staff.

The IRS gives business owners tax deductions on a range of basic expenses including home-office use and business travel. The Business Cost is the totality of all the costs incurred in carrying out the business operations. If your business sells more units of a certain item some of your costs.

Which two categories below are used for business costs. Fixed and variable c. Come tax time however small-business owners only care about what can be written off against net income to reduce the tax burden.

Direct versus indirect costs. Fixed versus variable costs. Variable expenses change from month to month.

Fixed Variable and Periodic. Gross and net c. You can use the standard mileage rate option or the actual expense option.

Fixed costs remain the same no matter how much business your small business does. The purchase of capital that has a useful life that extends into the future is generally considered an investment in an asset as opposed to an expense. As we mentioned earlier you may want to consult a tax professional for more detail.

They are sometimes called overhead costs and often include rent depreciation of capital investments management salaries property taxes. Private cost spent for business interests Variable cost will vary depending on the volume of output 2. A business expense is a business cost for goods and services that are used up quicklyAs a rule of thumb periodic payments such as monthly wages are considered expenses.

Small-business expenses are the necessary costs of running a business. This expense can be. Income earned from a job.

There are two options to write off the costs of using your vehicle for business. Capital expenses such as furniture and copiers depreciate in value over time. Set up your expense accounts to reflect your business.

Which two categories below are used for business costs. What Are the Three Major Types of Expenses. These two are used and very important in business cost because it shows whether a certain.

Such as raw material wages of labor energy. In the world of business there are two main types of expenses. Which two categories below are used for business costs.

Indirect expenses are shared operational costs. List of Expense Categories for Small Business. Material and labor gross and net fixed and variable cost of goods sold and administrative.

Materials and labor d. Fixed and variable d. A Gross and net B Fixed and variable C Materials and labor D Pre-tax and after-tax.

Every part of the business is associated with different types of business costs right from production up till marketing and even sales. Rent paid for factory premises. There are three major types of financial expenses.

Direct costs are easy to match with a process or product whereas indirect costs are more distant and have to be allocated to a process or product. Gross and net c. First gross and net wherein gross is the totality of the amount and the net is what remains after all the deduction.

It is also used in several other legal procedures. The firms compute their business cost to determine the profit and loss and for filing returns for income tax. Which two categories below are used for business costs.

Cost of goods sold and administrative. Materials and labor b. Fixed and Variable Costs.

Cost of goods sold and administrative. Track gas oil insurance and repair and maintenance spending. This expense can be Economic cost the person could earn more money by working for his business Opportunity cost same reason as above 3.

The following are common types of. The variable cost is the cost which changes with the change in the production. A Gross and net B Fixed and variable C Materials and labor D Pre-tax and after-tax B.

Construction Invoice Templates Sample Template Business And Resume Invoice Template Invoice Template Word Templates

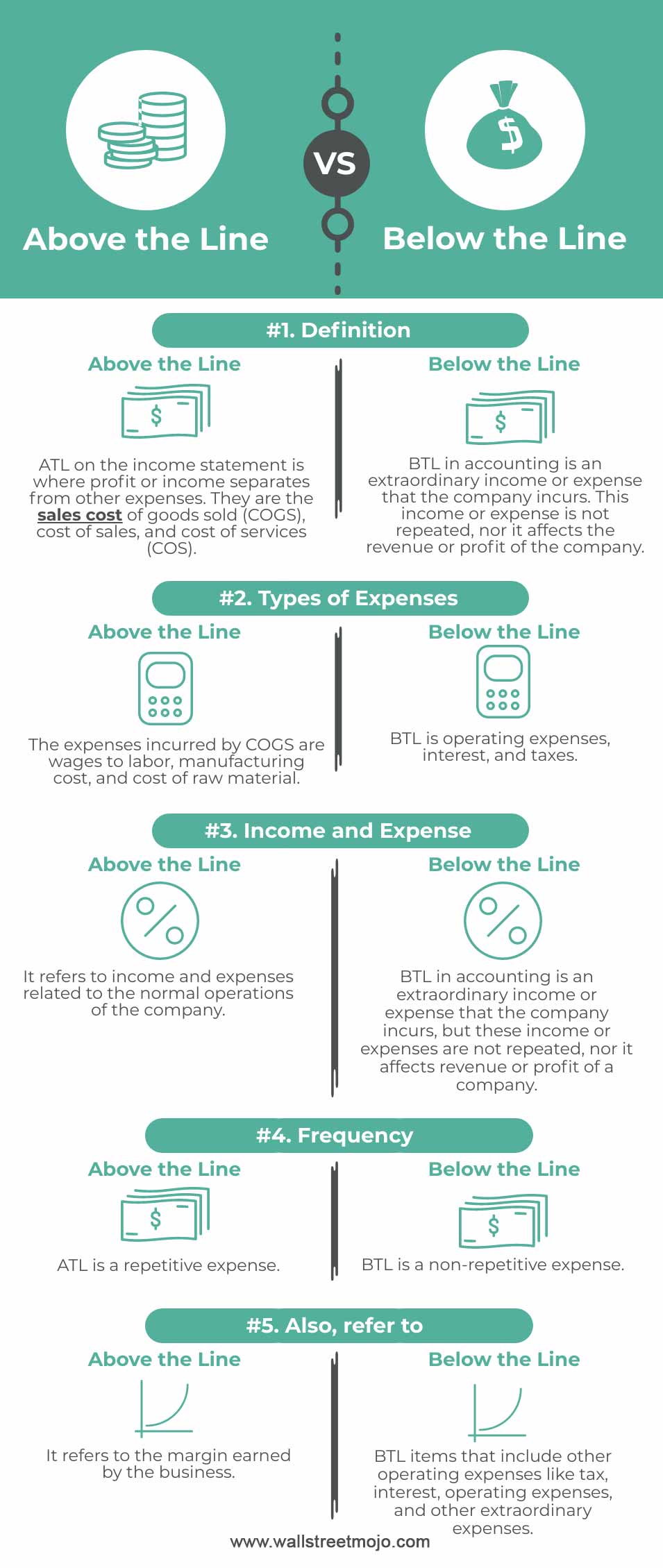

Above The Line Vs Below The Line Top 5 Best Differences Infographics

Complete Business Frameworks Reference Guide Key Success Factors Environmental Analysis Change Management

Comments

Post a Comment